The Renters Reform Bill has been marketed as a game-changer for tenants—ending “no-fault” evictions, empowering renters, and professionalising the rental sector. But behind the headlines lies a harder truth: this legislation is not without cost.

And someone will have to pay.

Here are five ways the Renters Reform Bill is likely to increase costs for both landlords and tenants.

1. Legal Complexity and the End of Section 21

Section 21 notices—often incorrectly called “no-fault” evictions—are set to be abolished. They are used by landlords in most cases when there is a cause (like unpaid rent, unsocial behaviour, drugs, prostitution). In their place, landlords will need to use Section 8 with specific, legally provable grounds for possession.

✅ Sounds fair? Maybe.

But in practice, this means longer and more contested court proceedings, higher solicitor fees, and more uncertainty.

🔹 Landlords will pay more in legal fees and risk longer void periods. Most are already taking additional insurance at an average cost of £20 a month.

🔹 Tenants may face higher barriers to entry as landlords become more selective, requiring guarantors or higher deposits (where allowed), particularly for vulnerable tenants. More demand and less supply will inevitably lead to increased rents.

2. Mandatory Redress Scheme

All landlords—even those with just one property—will be required to join an official redress scheme, much like agents currently do. This ombudsman will handle tenant complaints and disputes.

💰 The cost: membership fees, per-case fees, and time.

These are non-optional and recurring.

🔹 Landlords will absorb new fixed annual costs.

🔹 Tenants will indirectly fund this via rent increases.

3. The National Property Portal

A new digital property register will require landlords to log property details, certificates, and compliance records. The goal is transparency—but it also introduces another bureaucratic and financial burden. It also duplicates local licensing fees which on average have added £20 a month to rents.

There will likely be:

- A registration fee per property

- Ongoing admin to update details and stay compliant

- Penalties for non-compliance

🔹 Landlords with portfolios will face mounting admin costs.

🔹 Tenants may see this priced into their monthly rent.

4. Rent Control by Regulation

The Bill doesn’t introduce rent caps—but it limits rent increases to once per year with two months’ notice, and gives tenants more power to challenge rent rises through tribunal.

This strips landlords of pricing flexibility—especially during high inflation. The natural response?

➡️ Landlords set rents higher at the start to preempt future constraints.

🔹 Tenants face higher starting rents, especially in high-demand areas.

🔹 Rent control = risk pricing.

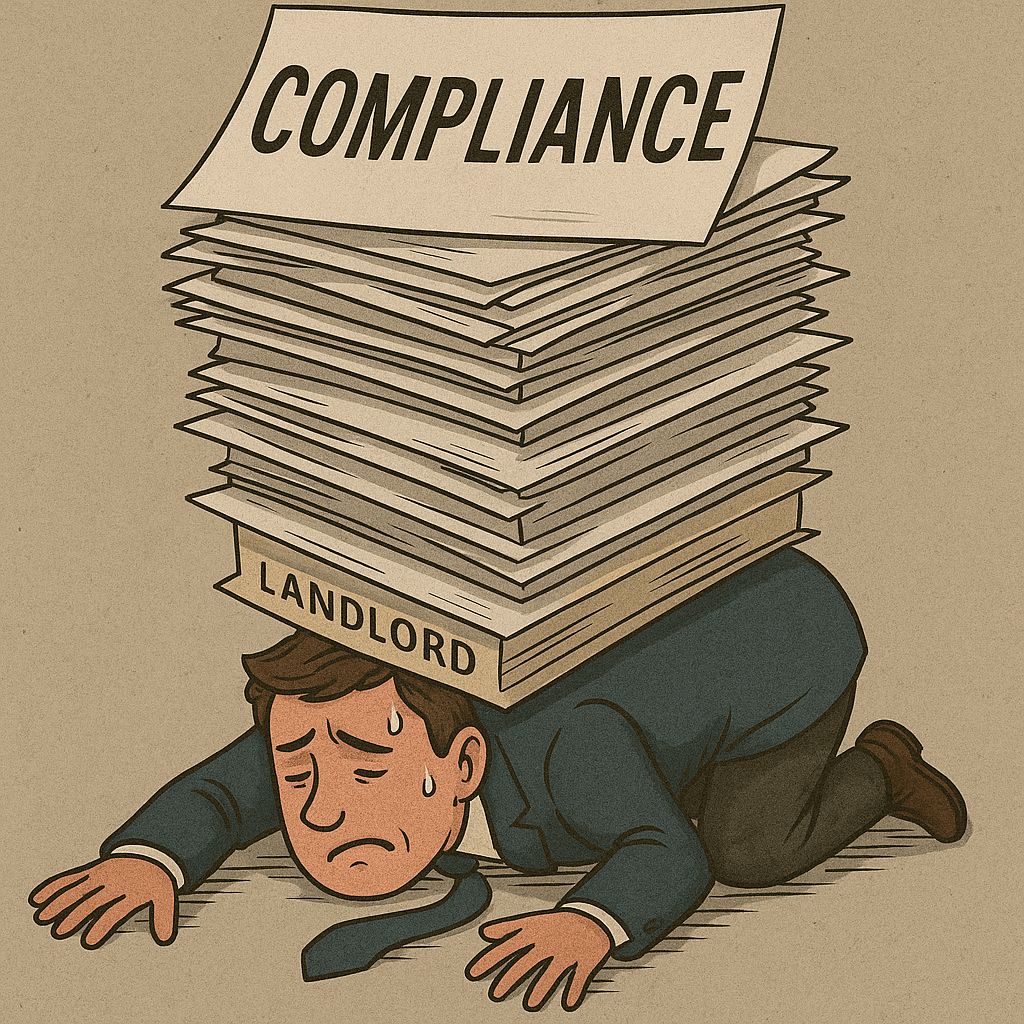

5. Upgrading to New Compliance Standards

While not a direct clause in the Renters Reform Bill, the government is pushing for changes to the Decent Homes Standard, and tightening enforcement of EPC requirements, fire safety, and HHSRS inspections.

These often require:

- New boilers or insulation

- Fire doors and smoke alarm systems

- Electrical and structural repairs

💸 Thousands in capital investment—often per property.

🔹 Landlords may sell up or increase rents to cover costs.

🔹 Tenants could face a shrinking supply and rising competition for compliant homes.

Conclusion: Reforms Without Real Support?

The Renters Reform Bill may improve long-term protections for tenants. But it’s also a cost driver—and in a market with finite supply and rising demand, costs tend to move in one direction only: up.

Professional landlords may adapt. Casual landlords may exit. Tenants? They may end up paying more for less.

Leave a comment